Hi everyone, I hope you’re feeling good after seeing the recent market pump and the positive news for both crypto and the global market. In this blog post, I’ll share the latest market updates along with my own point of view. We’ll also discuss whether the news about a possible rate cut in September is confirmed or not.

1. Jackson Home Economics (Summary)

On August 22, 2025, Federal Reserve Chair Jerome Powell spoke at the Jackson Hole Economic Symposium, signaling likely interest rate cuts in September due to a weakening labor market (4.3% unemployment, 73,000 jobs added in July).

Summary Points

1. Rate Cuts Signaled: Indicated likely interest rate cuts in September 2025 due to labor market weakness.

2. Labor Market Concerns: Unemployment at 4.3%, only 73,000 jobs added in July, signaling a slowdown.

3. Inflation Pressures: PCE inflation at 2.6%, above the Fed’s 2% target, partly driven by Trump’s tariffs.

4. Immigration Impact: Tighter policies slowed labor force growth, adding economic uncertainty.

5. Policy Framework Update: Revised Fed strategy, moving from flexible inflation targeting to adapt to volatile conditions.

6. Market Reaction: Stocks rose, Treasury yields fell, with 87% odds of a September rate cut per CME FedWatch Tool.

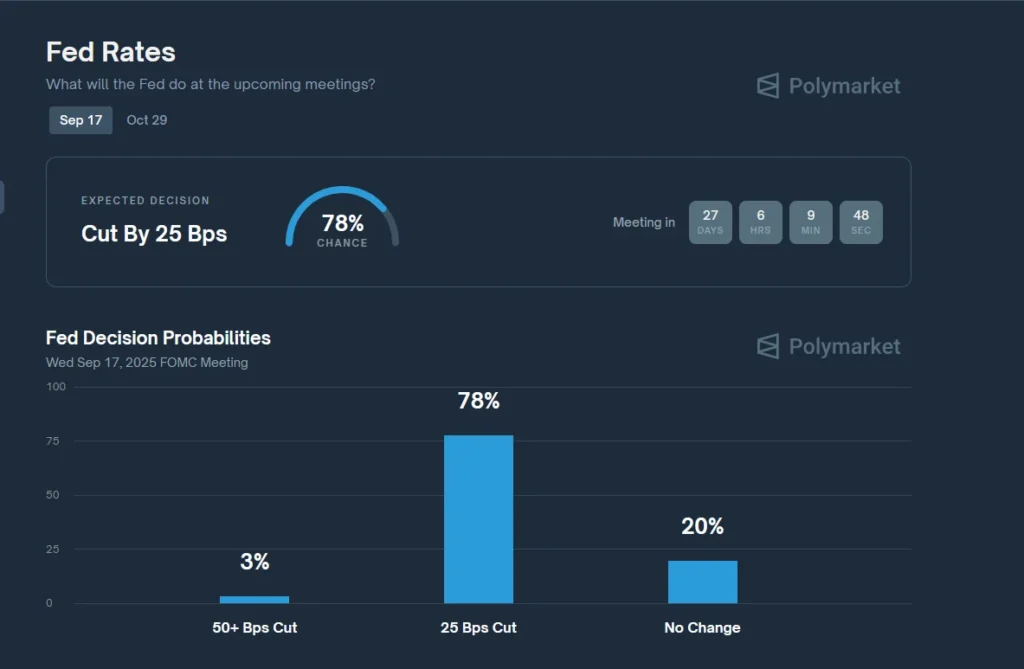

2. Rate Cut In September

After this news and Jerome Powell’s speech, the chances of a rate cut have increased significantly on Polymarket. Many traders are now betting on a September rate cut, and based on the current market sentiment, I also believe that the Federal Reserve is likely to move in that direction. Of course, nothing is confirmed yet, so we’ll have to wait and see how the upcoming data and official statements shape the final decision.

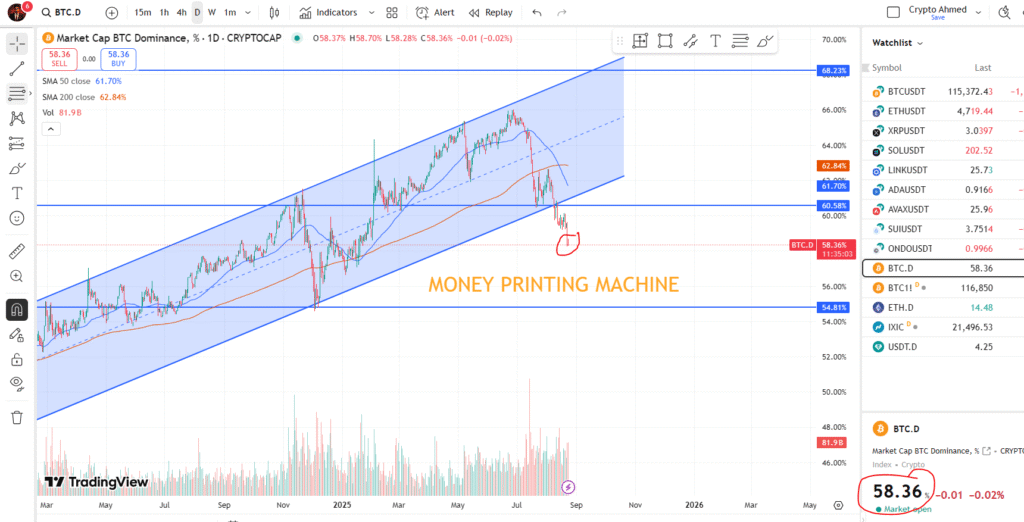

3. Bitcoin Dominance Down 🔻

Bitcoin dominance has dropped below 60%, which is considered a very positive signal for altcoins. When Bitcoin’s dominance decreases, it usually means that capital is starting to flow into other cryptocurrencies that haven’t pumped yet. This shift often creates strong opportunities for altcoins to rise, especially during the early stages of a bull run. If this trend continues, we could see many altcoins catching up and delivering significant gains alongside Bitcoin.

4. BTC & ETH – ETF Data

1. BITCOIN ETF Data according to Coinglass

| DATE | 22-AUGUST-2025 |

| GBTC | +56-91 |

| IBIT | -1.77K |

| FBTC | +452.60 |

| ARKB | +584.20 |

| BITB | +112.93 |

| BTCO | 0 |

| HODL | +234.75 |

| BRRR | 0 |

| EZBC | +120.04 |

| BTCW | 0 |

| BTC | 0 |

| TOTAL | -206.28 |

2. ETHEREUM ETF Data according to Coinglass

| DATE | 22-AUGUST-2025 |

| ETHE Grayscale | +10.87K |

| ETH Grayscale | +5.37K |

| ETHA Blackrock | +25.90K |

| ETHW Bitwise | +8.59K |

| FETH Fidelity | +27.91K |

| ETHV VanECK | – |

| EZET Franklin | +1.3K |

| CETH 21 Shares | 0 |

| QETH Invesco | 0 |

| TOTAL | +79.95K |

Overall, Bitcoin ETFs are showing negative trends while Ethereum (ETH) is positive. This suggests that big institutions are moving funds from BTC to ETH, which can also be seen as an early sign of an upcoming altcoin season.

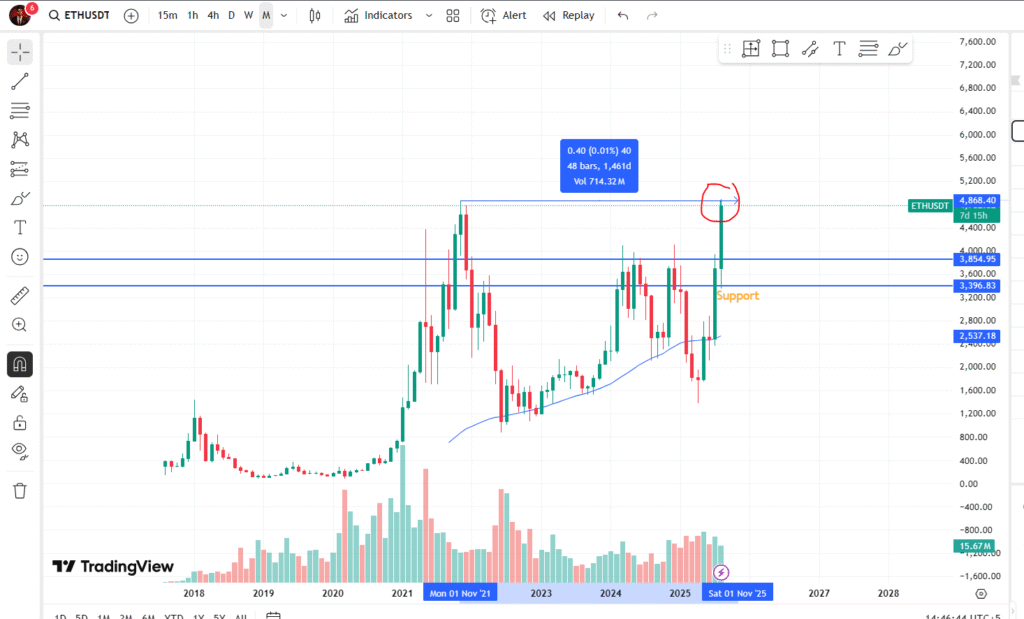

5. ETH & BNB Create New All-Time High

After nearly four years, Ethereum has finally created a new all-time high at around $4,900. In my personal view, the momentum is still strong, and if the current growth trend continues, Ethereum has the potential to reach $7,000 by the end of 2025.

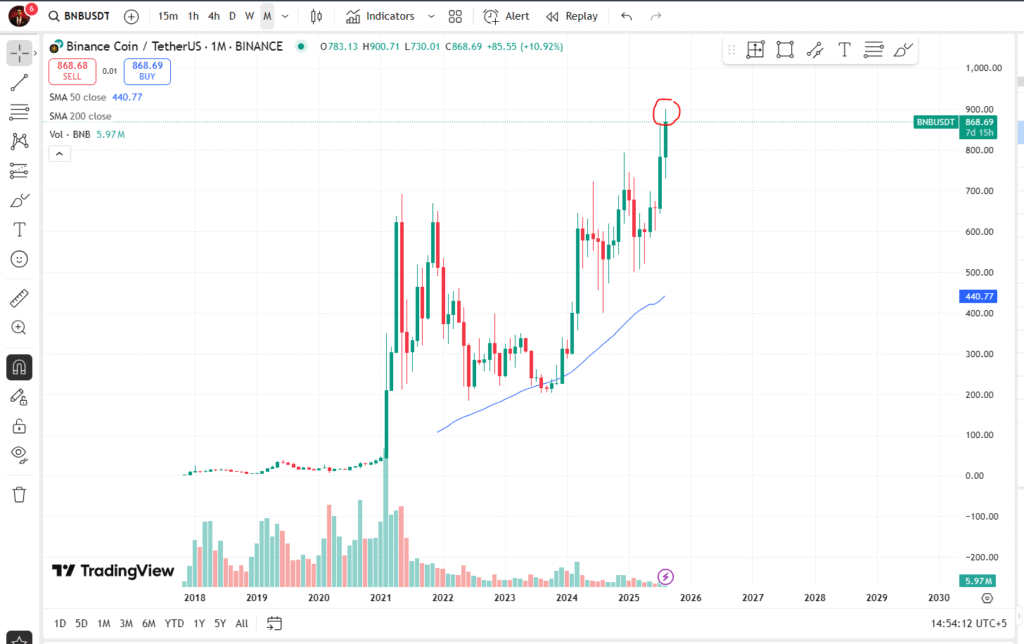

As most of you already know, Binance is one of the leading exchanges in the entire crypto industry. Its native token, BNB, has recently reached a new all-time high of around $900. With this achievement, BNB has strengthened its position in the market and successfully entered the list of the top 5 cryptocurrencies by market capitalization.

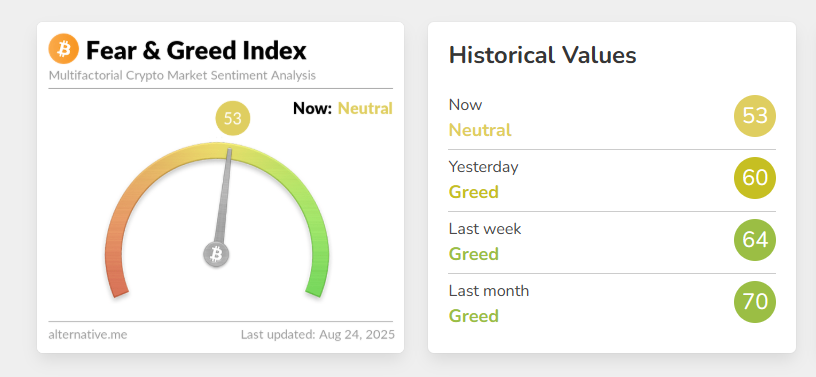

6. Fear & Greed Index

At the moment, the Fear and Greed Index is sitting at a neutral level of 53. In my opinion, this number is likely to rise by the end of August and could reach somewhere between 70 and 80. If that happens, the market may face a healthy correction, which is completely normal and expected in the crypto space.

You Might Like This

- Top 10 Bitcoin-Holding Nations Dominating the Crypto Game

- Top 5 Proven Strategies to Invest in Cryptocurrency Successfully

- Bitcoin or Gold – Which Is the Smarter Investment Today?

- Top 5 Real World Asset (RWA) Crypto Projects on CoinGecko in 2025

Conclusion

Overall, the market sentiment is positive, and almost every day we are seeing encouraging news for the crypto space. As we move into September, it’s uncertain whether the market will pump or dump, so traders should remain cautious. If you are trading, always use a stop-loss because the market is highly volatile, and just one piece of negative news can wipe out your portfolio. On the other hand, if you are a long-term investor, there is no need to panic. And for those trading futures, it’s always safer to use minimum leverage.