As you may know, October 29 marked one of the most important days for global investors — the announcement of the U.S. Federal Reserve’s interest rate decision. The Fed decided to cut the rate by 0.25%, a move that has significant effects on stocks, crypto, forex, and commodity markets around the world. Lower interest rates usually signal cheaper borrowing and can lead to increased market volatility as traders react to the news.

At the same time, former U.S. President Donald Trump has begun his Asia tour, which includes visits to China and other key countries in the region. During this trip, Trump met with Chinese President Xi Jinping to discuss trade relations, economic cooperation, and regional stability. The outcome of their meeting could influence global market sentiment, especially in sectors connected to trade and manufacturing.

In this blog, I’ll break down the latest market updates related to these major events and how they may impact your trading or investment decisions. Be sure to read through carefully before making any financial moves — and remember, I’m not your financial advisor. This content is for informational purposes only.

Fed Rate Cut 0.25%

Yesterday, the U.S. Federal Reserve announced a 0.25% interest rate cut, exactly as predicted by most economists and market analysts. This move was widely anticipated and is being seen as a positive signal for global financial markets. A rate cut generally lowers the cost of borrowing, encourages investment, and supports business growth — all of which tend to boost investor confidence.

This decision came at a crucial time when global markets were seeking stability amid economic uncertainty and ongoing geopolitical events. Analysts believe the 0.25% rate cut could help stimulate both consumer spending and corporate investments in the coming months. As a result, major stock indices, along with the crypto and commodity markets, reacted positively to the news, showing early signs of upward momentum.

For traders and investors, this is an important development to watch closely. The Fed’s decision could shape market sentiment for weeks ahead, influencing everything from bond yields to the value of the U.S. dollar.

Fed Chairman Powell’s Speech

Federal Reserve Chair Jerome Powell delivered his post-meeting remarks following the FOMC’s decision to cut the federal funds rate by 25 basis points—the second reduction this year—bringing the target range to 3.75%–4.00%. The move aims to support a softening labor market amid elevated inflation and a government shutdown disrupting data flows. Powell’s tone was cautious, emphasizing uncertainty and divisions within the Fed, which led to market volatility: the Dow reversed from a record high, Treasury yields rose, the dollar strengthened, and crypto saw $560 million in liquidations (mostly longs).

| Highlight | Details |

|---|---|

| Rate Cut Decision | The FOMC voted 10–2 to lower rates by 25 bps, citing “moderate” economic growth but slowing job gains (down to ~29,000/month pre-shutdown) and rising employment risks. This follows September’s initial cut after rates were steady since December 2024. |

| December Cut Uncertainty | Powell stressed a potential December cut “is not a foregone conclusion,” using strong language to highlight “strongly differing views” among officials—some favor caution due to inflation, others more easing. Markets priced in ~60% odds post-speech (down from 90%). |

| Inflation Outlook | Inflation has “moved up since earlier this year and remains somewhat elevated,” but core PCE (excluding tariffs) is nearing the 2% target. Tariffs add ~0.5% temporary boost; no official October data due to shutdown. |

| Labor Market Focus | Fed is “monitoring very carefully” amid layoffs at firms like UPS, Amazon, and Target, which could push unemployment above 4.3%. Powell noted internal Fed data helps fill the void from halted government reports. |

| Balance Sheet Normalization Ends | Quantitative tightening halts December 1, ending the runoff of the Fed’s $6.6 trillion balance sheet started earlier in 2025. This could ease liquidity without signaling aggressive easing. |

| Broader Remarks | – No excessive leverage in banking/financial systems. – Fed not responsible for stock valuations. – AI investments differ from dot-com era: current ones show real profits, not just hype. – Pushback on political pressure (e.g., from Trump calling Powell “incompetent”). |

Market Reactions

- Stocks: Dow closed lower after an intraday high, erasing gains on hawkish signals.

- Bonds/Currency: 10-year Treasury yields jumped; Bloomberg Dollar Index rose.

- Commodities/Crypto: Gold corrected; Bitcoin indecisive with heavy long liquidations.

Trump and Xi Jinping Meeting

U.S. President Donald Trump shared details about his meeting with Chinese President Xi Jinping, describing it as highly successful and respectful. According to Trump, both leaders discussed a wide range of economic and trade-related topics. China agreed to purchase large quantities of American agricultural products such as soybeans and sorghum, a move Trump said would greatly benefit U.S. farmers. He also mentioned that China would continue exporting rare earth minerals and work with the United States to address the flow of fentanyl, a key issue in America’s drug crisis.

Trump further stated that China plans to increase its imports of American energy, including oil and gas from Alaska, which could lead to major trade agreements in the near future. He emphasized that the meeting would bring economic prosperity and security to millions of Americans. After concluding his Asia visit, Trump thanked several countries — including Japan, South Korea, Malaysia, and others — for their hospitality and partnership. He ended his message by expressing optimism about America’s economic strength and future growth, saying, “The best is yet to come.”

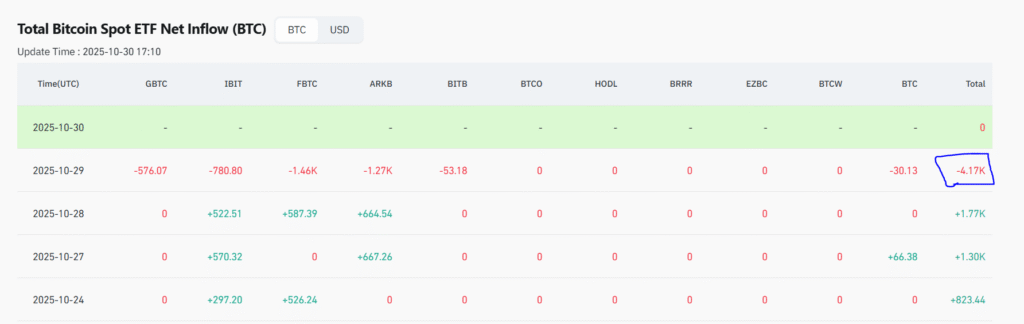

Bitcoin ETF Selling

Yesterday, while the interest rate decision was still pending, several Bitcoin ETFs sold a large amount of BTC, approximately $500 million worth, which equals more than 4,000+ Bitcoins.

France Proposes Ban on Digital Euro, Supports Crypto Adoption

A new proposal submitted to the French National Assembly on October 22, 2025, has sparked major discussion across Europe’s financial and crypto communities. The document, officially titled “Proposal for a European Resolution,” was filed under the Constitution of October 4, 1958, during the Seventeenth Legislature. It has been referred to the Committee on European Affairs for further review.

The proposal calls for a complete transformation of the monetary system, urging the European Union to ban the Central Bank Digital Euro (CBDC) and instead focus on promoting euro-backed stablecoins and investment in crypto assets. In simple terms, it pushes back against centralized digital currencies controlled by governments and supports a freer, blockchain-driven financial ecosystem. If adopted, this move could mark a historic shift in Europe’s financial policy, strengthening the position of decentralized finance (DeFi) and giving more power to individuals and private institutions in shaping the digital economy.

You Might Like This

- How to Create Accurate Crypto Signals for Any Altcoin

- S&P 500 Hits New All-Time High Ahead of U.S. Interest Rate Decision – Crypto Market Updates

- How to Buy and Set Up Your First Web3 Domain: The Complete Step-by-Step Guide

- Crypto’s Top 10 Stablecoins: Which Ones Are Leading the Market in 2025?

Conclusion

The Fed’s 0.25% interest rate cut and Trump’s meeting with Chinese President Xi Jinping have created a wave of optimism in global markets. Lower rates often fuel growth, while stronger U.S.–China relations can improve trade confidence and global stability. However, investors should remain cautious, as future policy decisions and economic data will determine whether this short-term rally can turn into long-term momentum.