In 2025, the number of hacking attempts in the crypto world has increased significantly. Millions of dollars worth of Bitcoin have been stolen in major incidents like the Bybit hack, CoinDCX breach, and several other exchange attacks. If you own Bitcoin and are concerned about how to store it safely away from hackers and dark web threats, this blog is for you. Here, I’ll explain everything you need to know about protecting your Bitcoin and ensuring your digital assets remain secure.

When it comes to cryptocurrency, security is everything. Whether you hold thousands of Bitcoins or just 0.1 BTC, safeguarding your assets is crucial. Once your Bitcoin is lost or stolen, it’s almost impossible to recover because the blockchain system is decentralized and irreversible. That’s why understanding how to properly store your Bitcoin is the first step toward becoming a responsible crypto investor.

There are several safe and reliable ways to store your Bitcoin, and in this blog, I’ll explain each method in detail. So, let’s dive in and explore how you can keep your Bitcoin secure.

1. Exchange (convenient for trading)

If you trade Bitcoin on a daily basis, you’ll need to use a crypto exchange such as Binance, Bybit, or Coinbase. For example, if you buy Bitcoin at $100,000 and the price rises to $105,000, you’ll need an exchange to sell it and take your profit.

However, many experienced and long-term crypto traders often say, “Use exchanges like public washrooms—use them when needed, then leave immediately.” In simple terms, don’t keep your funds on exchanges for too long, as they’re more vulnerable to hacks and security breaches.

Examples: Coinbase, Kraken, Binance.

Pros: easy access, simple recovery via account login.

Cons: You do not control private keys. Use only for funds you actively trade with or small balances.

2. Software (hot) Wallets

Software wallets, also known as hot wallets, are digital tools that let you store, send, and receive Bitcoin online. They’re called “hot” because they stay connected to the internet, which makes them convenient for quick transactions but also slightly more vulnerable to hacking compared to offline (cold) wallets.

Hot wallets come in different forms, such as mobile apps, desktop software, and web wallets. Some popular options include Trust Wallet, MetaMask, and Electrum. These wallets are ideal for traders or users who make frequent transactions because they provide easy access to funds anytime, anywhere.

However, since they’re online, it’s important to secure them properly—use strong passwords, two-factor authentication (2FA), and never share your private keys or recovery phrases with anyone. For long-term storage, it’s usually better to transfer your Bitcoin to a cold wallet once you’re done trading.

Examples: Electrum (desktop), BlueWallet, Trust Wallet, Coinbase Wallet (non-custodial).

Pros: convenient, fast.

Cons: connected to the internet so higher attack surface.

3. Hardware Wallet (best for long-term storage)

A hardware wallet is one of the safest ways to store your Bitcoin, especially if you plan to hold it for the long term. Unlike software wallets, hardware wallets are offline physical devices that store your private keys securely without ever connecting to the internet. This makes them almost impossible for hackers to access remotely.

When you want to send or receive Bitcoin, you simply connect your hardware wallet to your computer or phone, approve the transaction, and then disconnect it again. This short online exposure keeps your crypto safe from online threats.

Some of the most trusted hardware wallets in 2025 are Ledger Nano X, Ledger Nano S Plus, and Trezor Model T. Although they cost between $70 to $200, they’re worth the investment if you hold a significant amount of Bitcoin.

In short, if your goal is long-term Bitcoin storage, a hardware wallet is the best option for maximum security and peace of mind.

Examples: Ledger, Trezor. Private keys stay offline.

Pros: very secure against online attacks.

Cons: small one-time cost, you must keep seed phrase safe.

4. Multisignature Wallet (Best for High Security)

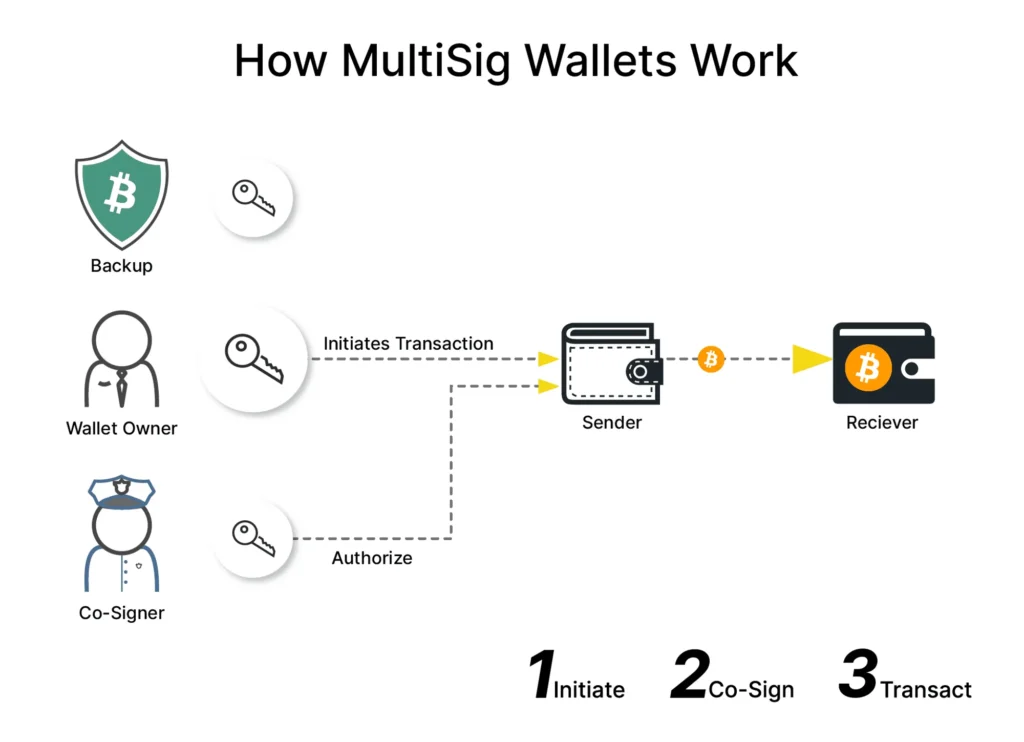

A multisignature wallet, often called a multisig wallet, adds an extra layer of protection to your Bitcoin storage. Instead of relying on a single private key to approve transactions, it requires multiple keys—for example, two or three out of a total of five authorized keys—to sign and complete any transaction.

This setup makes it much harder for hackers to steal your Bitcoin because even if one key is compromised, they would still need access to the other keys to move your funds. Multisig wallets are especially useful for businesses, joint accounts, or users managing large amounts of Bitcoin who want to minimize the risk of a single point of failure.

Popular multisignature wallets include Electrum, Casa, and BitGo. These platforms allow users to customize how many signatures are required and who controls them, giving you complete flexibility over your security setup.

In simple terms, a multisignature wallet offers bank-level protection for your Bitcoin by making sure that no single person—or hacker—can move your funds alone.

Differences Between Exchange, Hot and Cold Wallet

| Feature | Exchange Wallet | Software (Hot) Wallet | Hardware (Cold) Wallet |

|---|---|---|---|

| Connection Type | Always online | Online | Offline (except during transactions) |

| Control of Private Keys | Controlled by the exchange | Controlled by the user | Controlled by the user |

| Security Level | Low – vulnerable to hacks | Medium – secure with proper setup | Very high – safe from online attacks |

| Ease of Use | Very easy and beginner-friendly | Easy to use | Requires setup, less convenient |

| Best For | Short-term traders | Regular users and small holders | Long-term investors and large holders |

| Examples | Binance, Bybit, Coinbase | Trust Wallet, MetaMask, Electrum | Ledger Nano X, Trezor Model T |

| Cost | Free | Free | Paid ($70–$200) |

| Risk of Hacking | High | Moderate | Extremely low |

| Backup/Recovery | Exchange handles it | Seed phrase recovery | Seed phrase recovery |

| Recommended Usage | For trading only | For frequent transactions | For long-term storage |

Video Tutorial

If you want to learn in more detail how software and hardware wallets work and understand them in depth, watch this video by Cyber Scrilla. It explains everything clearly and is perfect for beginners. Don’t forget to subscribe to their YouTube channel for more informative videos related to cryptocurrency and blockchain security.

Video Credit: Cyber Scrilla

You Might Like This

- Bitcoin or Gold – Which Is the Smarter Investment Today?

- Bitcoin Price Prediction for 2025: What Major Institutions Are Forecasting

- US CPI Data and FOMC Meeting Highlights: Key Market Updates Today

- Top AI-Powered Altcoins Changing the Future of Blockchain Technology

Conclusion

In 2025, Bitcoin security is more important than ever. With frequent exchange hacks and online scams, choosing the right storage method can make all the difference. If you trade daily, using a trusted crypto exchange is fine for quick transactions, but never keep large amounts there. For regular users, software wallets offer convenience with moderate security. However, if you’re holding Bitcoin for the long term, a hardware wallet or multisignature wallet is the safest choice.

Remember, once your Bitcoin is stolen, it’s nearly impossible to recover. Always keep your private keys secure, back up your wallet, and stay informed about the latest security practices. Protecting your Bitcoin means protecting your financial freedom.